The Company has formulated “TaKaRa Group Challenge for the 100th,” our long-term management vision ending in the fiscal year ending March 31, 2026, which is the 100th anniversary of the Group’s foundation. The Challenge sets forth “Where the Takara Group wants to be (Vision)*” as well as management strategies and business strategies in order to achieve this Vision.

The company believes that achieving this Vision will lead to the sustainable growth of the Group and an increase in corporate value over the medium- to long-term, and that what is required to effectively and efficiently realize this Vision is a corporate governance structure that ensures a transparent, fair, speedy and resolute decision making. At the same time, we also believe that to continue to be a trusted corporate group, we need a structure that respects the positions of stakeholders, including shareholders, customers, employees, creditors, and local communities, and enables us to make efforts in appropriate communication.

The Company aims for sustainable growth and an increase in corporate value over the medium- to long-term by establishing a corporate governance structure based on the above policy, and will make efforts in accordance with the specific policies set forth in the Takara Holdings Corporate Governance Policy.

- Where the Takara Group wants to be(Vision)

“Smiles in Life – Smiles are Life’s Treasures”

The Takara Group is committed to enriching the homes, lifestyles, and lives of people around the world with smiles. Leveraging our expertise in the pursuit of delicious taste and innovative biotechnologies, we are a corporate group who safely and securely provide diverse value across the washu, Japanese food, and life science sectors.

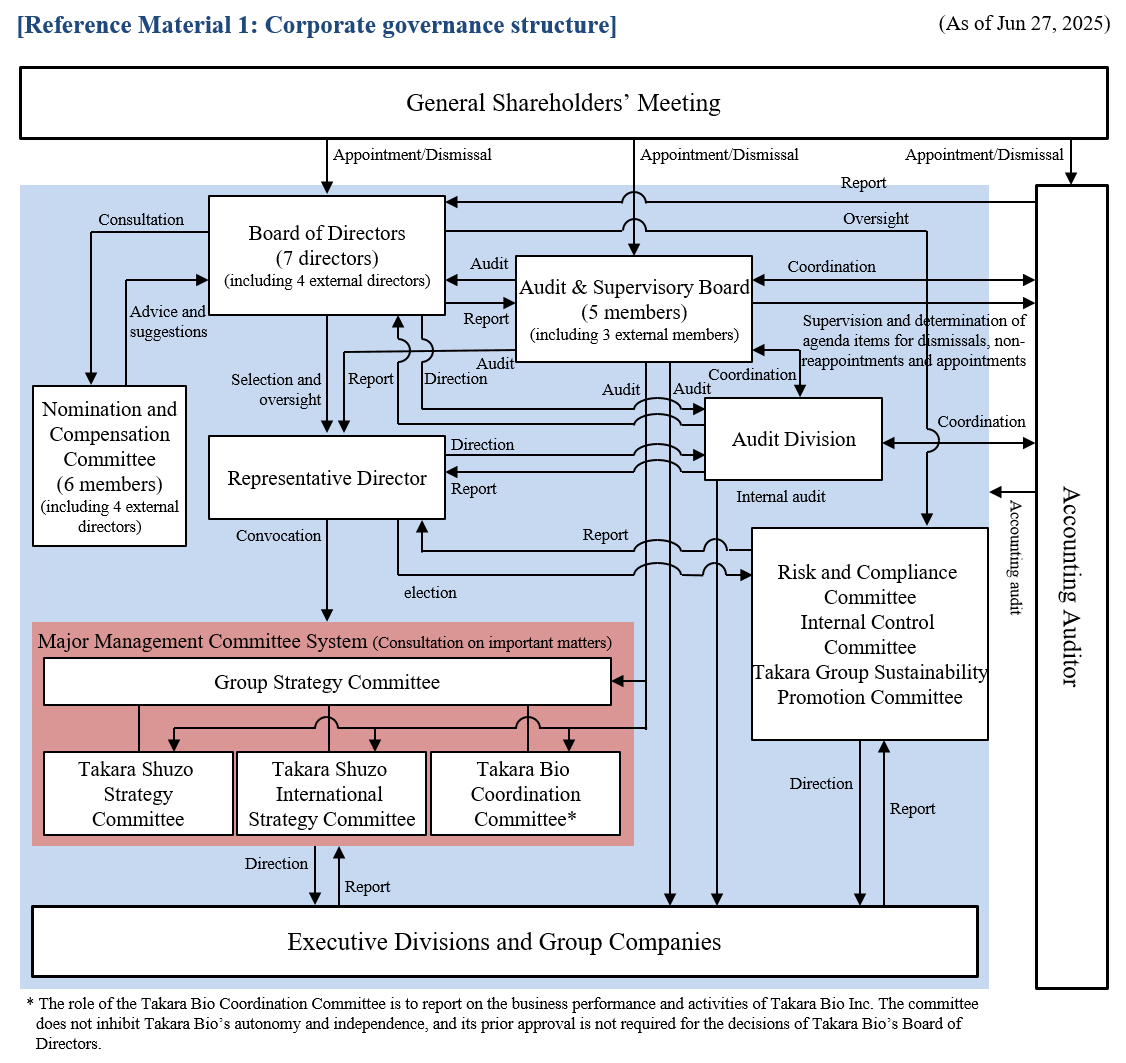

As a holding company that manages a corporate group, Takara Holdings has decided that the following framework will be most appropriate for the Takara Group to ensure highly effective supervision and audits of corporate management. Hence, we have adopted a system of a Company with an Audit & Supervisory Board as our corporate governance structure.

- The Board of Directors makes important management decisions and supervises the execution of operations. The Board consists of executive Directors with highlevel of expertise and experience related to ourbusinesses and multiple independent external Directors with a wealth of experience and a broadview who are capable of offering advice and suggestions from the perspectives of all stakeholders including shareholders.

- Audit & Supervisory Board Members with the knowledge of finance, accounting, and legal affairs, including independent external Audit & Supervisory Board Members with a wealth of experience and a broad view, comprise the Audit & Supervisory Board. Each Audit & Supervisory Board Member effectively exercises their function and authority to audit the execution of operations by Directors.

With these frameworks in place, external Directors and Audit & Supervisory Board Members monitor, supervise, and offer advice on Directors’ business management and performance of duty according to their roles and functions from their independent and objective standpoint, thereby providing highly effective supervision.

|

Initiative themes |

Specific measures |

Targets |

|

Promotion of corporate governance |

Establish an optimum corporate governance structure

|

[ TAKARA HOLDINGS INC. ] |

|

Consider optimum corporate governance |

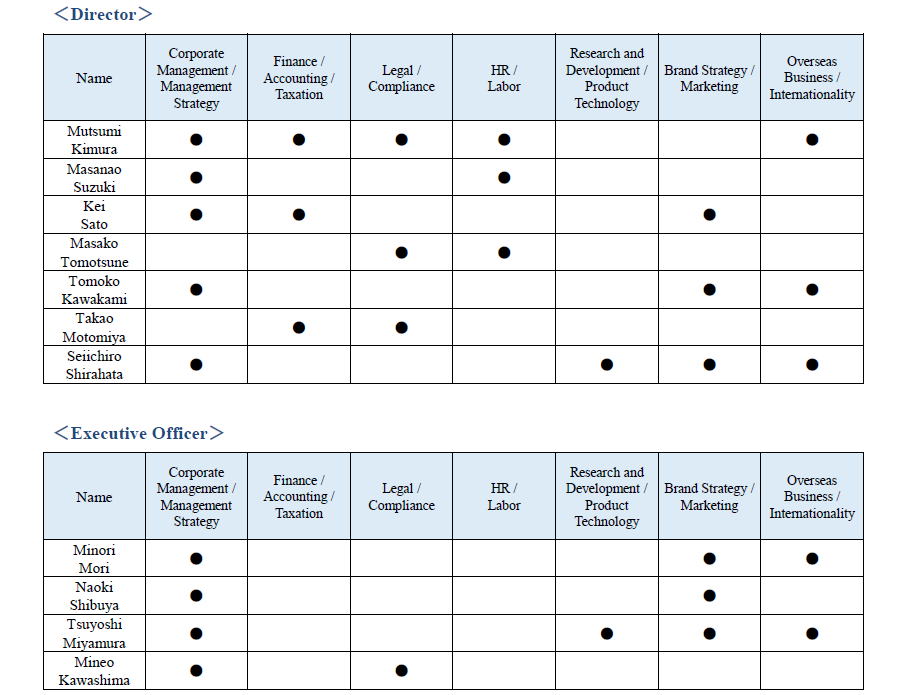

The Company shall appoint as directors the persons deemed most suitable from the perspectives of mutually complementing the execution of business and strengthening the oversight functions of the Board of Directors based on each of their skills, knowledge, experience, expertise, etc. from among persons who meet certain criteria without being restricted by gender, nationality, work experience, and age, etc. The Company believes that this approach secures the required diversity of the Board of Directors as a whole. At present, four out of the Company’s seven directors are external directors, and two directors are female.

In addition, the term of directors is one year to enable swift response to the business environment and to clarify management responsibility.

A skills matrix of the Board of Directors and Executive Officer are presented in “Expertise and Experience of Directors (skills matrix)” below.

Each year, Takara Holdings evaluates the effectiveness of the Board of Directors from the perspective of how it functions as a meeting body and how it fulfils its role as an organizing body for improving corporate value over the medium- to long-term. An overview of the results of the assessment for the fiscal 2024 (year ended March 31, 2025) is as follows.

The Company appoints Audit & Supervisory Board members who possess financial, accounting, and legal affairs knowledge, in order to ensure functions necessary to perform the roles and responsibilities of the Audit & Supervisory Board members and the Audit & Supervisory Board. At present, three out of the Company’s five Audit & Supervisory Board members are external Audit & Supervisory Board members and three Audit & Supervisory Board members are female. In addition, three out of the Company’s five Audit & Supervisory Board members have sufficient financial and accounting knowledge.

Takara Holdings has established criteria for independent officers, which are more rigorous than those specified by the Tokyo Stock Exchange, and it designates all of the external officers who are deemed to be independent by meeting these criteria as independent officers. Currently, a total of seven officers are designated as independent officers. They are External Directors Masako Tomotsune, Tomoko Kawakami, Takao Motomiya, and Seiichiro Shirahata, and External Audit & Supervisory Board Members Akiko Yoshimoto, Akiko Yakura, and Aki Miyaguchi.

To ensure the independence and objectivity of the Board of Directors’ functions regarding the nomination of Director candidates and Director compensation, Takara Holdings has established the Nomination and Compensation Committee with a majority of independent external Directors under the Board of Directors and ensures their appropriate participation.

<Matters to be discussed>

• Matters concerning candidates for directors to be proposed to the general shareholders’ meeting

• Matters concerning revisions to the maximum amount of compensation for directors to be proposed to the general shareholders’ meeting

• Matters concerning compensation of individual directors

• Other matters concerning nomination and compensation of directors

Compensation for Directors and Audit & Supervisory Board Members is determined based on the Rules for Compensation of Officers approved by the Board of Directors within the range of the amount for each based on resolutions at the general shareholders’ meeting. Compensation for Directors is determined by the Representative Director and President delegated by resolution of the Board of Directors, upon deliberation by the Nomination and Compensation Committee; while compensation for Audit & Supervisory Board Members is determined by deliberation by the Audit & Supervisory Board Members. Revisions to the Rules for Compensation of Officers relating to Directors are based on resolutions by the Board of Directors, while revisions relating to Audit & Supervisory Board Members are subject to consultation with the Audit & Supervisory Board Members.

Compensation for executive Directors consists of a fixed amount of compensation in accord with the Director’s title and role, plus performance-linked compensation to enhance incentive, while compensation for outside Directors and Audit & Supervisory Board Members consists of a fixed amount of compensation only, taking their role into consideration.

The amount of performance-linked compensation for each executive Director is determined based on the amount of performance-linked compensation paid for the previous fiscal year and each of their performance evaluation points of the previous fiscal year.

The performance evaluation points are calculated using consolidated operating income, a management indicator on which the Company attaches the greatest importance, as the primary evaluation indicator, in addition to the degree of achievement of ROIC and sustainability measures, among others.

In our Group, the Company and Group companies may strategically hold shares of the companies that have business relationships with individual companies in the Group. Such strategic holding of shares shall be implemented only if the Board of Directors of the Group company intending to purchase said shares acknowledges that the shareholding is reasonable as a means of business alliance, maintenance and enhancement of transaction, etc., and in view of the benefits and risks. With regard to the individual shareholdings, the Board of Directors of the Company shall annually judge whether to continue to hold shares through the examination in terms of the contribution to the achievement of continuous growth of the Group and an increase in its corporate value over the medium- to long-term, and disclose the results of its judgement. For shareholdings acknowledged to have no economic rationale, cross-shareholdings shall be reduced through sale in a timely manner upon consultation with the company in question. Meanwhile, on being informed by a company that holds cross-shareholdings of the Company’s shares (the shareholder of cross-held shares) that the company in question intends to sell the Company’s shares, the Company shall respect the said intention. With respect to exercising the voting rights of the companies in which shares are held, each Group company shall, based on the examination of all proposals, in principle, judge comprehensively whether or not the proposal contributes to the achievement of continuous growth of the Group and an increase in its corporate value over the medium- to long-term and the shareholders’ common interest of the Group and the invested company so as to exercise them appropriately. This includes opposing proposals in cases when earnings have been poor for a certain period, when it is acknowledged that management strategy or financial strategy will damage shareholder interests, when illegal or anti-social acts are acknowledged, and other similar cases.

With the aim of further improving capital efficiency, the Company resolved at the Board of Directors meeting held on May 13, 2025, to reduce the total amount of cross-shareholdings by 50% during the period between March 31, 2025 and March 31, 2030.

The Company sold 10 stocks in total by the end of the fiscal year ended March 31, 2025: 10 of the 11 stocks designated as considered for sale (including stocks for which a portion of our holdings are eligible for sale) at the Board of Directors’ meeting held on May 10, 2024.

With the aim of further improving capital efficiency, the Company resolved at the Board of Directors meeting held on May 13, 2025, to reduce the total amount of cross-shareholdings by 50% during the period between March 31, 2025 and March 31, 2030.

The Company also reviewed the appropriateness of continuing to hold all the cross shareholdings held by the Company and its subsidiaries as of March 31, 2025 at the Board of Directors’ meeting held on May 13, 2025. It was decided to proceed with the consideration of the timely sale of 7 stocks designated as considered for sale out of a total of 68 stocks (7 stocks of financial institutions, 16 stocks of suppliers & companies that receive orders, 35 stocks of customers & retailers, and 10 stocks of other related parties).

As a holding company, Takara Holdings has established the “Rules and Regulations for Overseeing Group Companies” that specify matters necessary to manage the Group companies. We require these companies to regularly report on their business activities while ensuring that they maintain their uniqueness and autonomy, and to discuss material matters with us before making any decisions or report decisions to us as soon as they are made. This way we support their appropriate risk-taking while supervising their execution of operations.

We have meeting bodies in place as described below in order to ensure that operational decisions are made and information is delivered properly and promptly.

- The Group Strategy Committee meets at least six times a year as a rule to discuss material matters related to the overall management of the Takara Group, review each Group company’s performance, and report updates on activities.

- The Takara Shuzo Strategy Committee and the Takara Shuzo International Strategy Committee each meet once a month as a rule to hold preliminary discussions on material matters, including the matters to be resolved at the Boards of Directors of Takara Shuzo Co., Ltd. and Takara Shuzo International Co., Ltd., report on these matters, and provide updates on relevant activities.

- The Takara Bio Coordination Committee meets once a month as a rule to make an ex post facto report on material matters including the matters resolved at the Board of Directors of Takara Bio Inc., which is a listed subsidiary of Takara Holdings, as well as updates on relevant activities.

- Each of the other subsidiaries holds the Strategy Committee and the Consultation and Coordination Committee four times a year as a rule to hold preliminary discussions on material matters, including the matters to be resolved at the Board of Directors of each of these subsidiaries, report on these matters, and provide updates on relevant activities.

As of June 27, 2025 (hereinafter, “as of the date this report is filed”), the Company is the parent company of Takara Bio Inc. (listed on the Prime Market of the Tokyo Stock Exchange, Securities Code 4974; hereinafter “Takara Bio”), holding 60.93% of the voting rights of Takara Bio.

On April 1, 2002, Takara Bio was spun off from the parent company as a wholly owned subsidiary to take over the Company’s biomedical business unit. Subsequently, the parent company’s share of voting rights was reduced to its current level through third party capital increases, public subscriptions, the issue of bonds with stock acquisition rights, and other corporate actions carried out by Takara Bio.

As of March 31, 2025, the Group comprises the Company, which is a holding company, 68 subsidiaries and 2 affiliates. Takara Bio is positioned as the subsidiary specializing in life science to promote the Biomedical Business for the Group. Takara Bio is not a competitor of any other segment in the Group and has only limited dealings with the Company.

<Views and policies concerning the Group’s management>

- Based on our corporate philosophy, which is “Contributing to the creation of a vital society and a healthy lifestyle through our fermentation technology and biotechnology in a way that achieves harmony with nature,” the Company and the Group benefits society by unlocking new potential in the culinary, lifestyle, and life science fields through our fermentation technologies for traditional Japanese sake and our cuttingedge innovation in biotechnologies and by continuing to create new value.

- The Company believes that achieving the vision in the long-term management plan, “TaKaRa Group Challenge for the 100th,” which will end in the fiscal year ending March 31, 2026, the 100th anniversary of the Group’s foundation will lead to an increase in corporate value of the Group as a whole.

- To achieve the vision, the Company’s basic approach is to respect the independence of each Group company, and have each company increase the speed of its management through independent management and pursue business outcomes to the utmost extent. The Company also believes it is important to integrate the business plans of each company for the overall optimization of the Group and to decide on the effective allocation of management resources such as funds and personnel by continuously identifying and analyzing the status of business execution.

- This is a system that consolidates management resources and aims for growth in three business segments:

Takara Shuzo, which handles our domestic business, Takara Shuzo International Group, which handles our international business, and Takara Bio Group, which handles our Biomedical Business. We have clarified the division of roles between the business companies that give undivided attention to promoting above businesses and the Company, which strongly supports the business of each company and leads the overall management of the Group.

<Significance of having a listed subsidiary>

- As part of the long-term management plan, “TaKaRa Group Challenge for the 100th,” the Group has adopted the vision: “Smiles in Life.” Toward the achievement of the vision, we believe that in the JTAB, Japanese food, and life science categories, enhancing our two unique business models will lead to greater corporate value. In particular, having Takara Bio, which generates value in the life sciences category, in our business portfolio is extremely important for maximizing the Group’s corporate value in the future. Moreover, we recognize as a Group strength the robust independence of our diverse businesses, each differing in business content and geographic focus. This enables us to build a well-balanced and resilient portfolio capable of adapting to changing environments.

- We also believe that Takara Bio needs to have its own means of financing in order to further accelerate growth of our Biomedical Business. Moreover, to hire and train talented employees and further advance the management of Takara Bio, we believe it is vital to maintain Takara Bio as a listed subsidiary.

- When Takara Bio was listed in 2004, we restructured its transactional relationships with the Company, the parent company, and Takara Shuzo, a fellow subsidiary, to avoid any conflicts of interest. No conflicts of interest exist at present.

- Takara Bio does not participate in the Company’s cash management system and thus, independently manages its own financing and liquidity.

- While disadvantages of having Takara Bio as a listed subsidiary include the outflow of economic benefits and the cost of maintaining its listing, we believe these are outweighed by the advantages described above.

<Measures to ensure the effectiveness of the governance system of the listed subsidiary>

- The Takara Bio Corporate Governance Policy stipulates that one-third or more of directors at Takara Bio (three out of nine as of the date this report is filed) must be independent external directors with no vested interest in Takara Bio or the Company. Hence, we believe that we have a system in place for protecting the rights of Takara Bio’s general shareholders and ensuring independent decision-making. Furthermore, three of the five Audit & Supervisory Board members at Takara Bio are independent external Audit & Supervisory Board members.

- In addition, for the purpose of protecting the interests of Takara Bio’s minority shareholders, Takara Bio deliberates and considers matters related to important transactions and acts in which the interests of the Company or its subsidiaries conflict with the interests of Takara Bio’s minority shareholders, in a special committee composed of three or more independent members, including external directors. Takara Bio advises and recommends the results to the Board of Directors of Takara Bio.

- The Company has established the Rules and Regulations for Overseeing Group Companies from the viewpoint of consolidated business administration. The objective of these Rules and Regulations is to ensure that our Group companies maintain their uniqueness and autonomy while the corporate value of the overall Group is maximized. In the said Rules and Regulations, the Group companies are classified according to their attributes, including capital relationships. Although we apply the said Rules and Regulations to Takara Bio, the Company does not require preliminary discussions or prior approval on material matters, including the matters to be resolved at the Board of Directors, and provides for reporting only, based on the classification of the Rules and Regulations. Hence, Takara Bio runs its business independently.

- Mutsumi Kimura, the Representative Director and President of the Company, concurrently serves as a director of Takara Bio. He was, however, invited by Takara Bio based on the judgment that his experience and knowledge gained through his management of Takara Bio in the past would be useful to Takara Bio and not for the purpose of the Company controlling Takara Bio. Furthermore, in receiving the proposal of agenda items for the appointment of corporate executives of Takara Bio, the Company does not engage in the nomination process in advance.

The following "Corporate Governance Report" has been submitted to the Tokyo Stock Exchange.

The Takara Group aims to achieve corporate philosophy; "Contributing to the creation of a vital society and a healthy lifestyle through our fermentation and biotechnology, emphasizing harmony with nature."

In the process of realizing it, we perform business activities honestly and fairly under the Takara Five Values, which are the shared values of the Group.

- We will comply with laws and regulations in Japan and overseas, fully recognize social ethics, and act with common sense and responsibility as a member of society.

- We will work to lower environmental burdens, and contribute to the development of life science that values the dignity of life.

- We will conduct sustainable business activities that are widely useful to society by pursuing profit through fair competition rather than pursuing profit in a manner contrary to these Action Guidelines.

- We will comply with employment regulations, and will not engage in any unfair or dishonest practices in violation of employment regulations.

- We will always draw a line between public and private matters, and will not pursue personal gain by using corporate assets, information, business authority, or position.

*"Takara Group Compliance Action Guidelines" have been distributed and disseminated to each group company, translated into the languages of the countries where group companies are located, including English, Chinese, French, Spanish, and German.

"Takara Group Compliance Action Guidelines" are supervised by the responsible executive officer of Takara Holdings. Regular reviews and revisions are conducted to assess the effectiveness of their comprehensive implementation, including anti-corruption measures (prohibition of bribery and other corrupt practices, as well as excessive entertainment and gifts, etc.).

To ensure sincere and fair corporate activities, the Takara group has established a "Risk and Compliance Committee" chaired by the President and CEO of Takara Holdings and supervised by the Takara Holdings Board of Directors. This committee aims to strengthen the risk management and compliance promotion system across the group. The "Takara Group Compliance Action Guidelines" are communicated to all employees through the intranet and booklet distribution, ensuring that each group company adheres to these guidelines, properly complies with compliance, and manages risks. This not only prevents serious compliance violations, including corruption, but also aims for the entire Takara Group to fulfill its corporate social responsibility and enhance corporate value.

|

Initiative themes |

Specific measures |

Targets |

| Promotion of compliance | Reinforce the compliance promotion structure |

[ Entire Group ]

|

| Implement compliance education | ||

|

Appropriately operate the whistleblowing system |

To raise compliance awareness, Takara Group distributes monthly "Compliance Newsletters" on familiar compliance-related topics, and conducts monthly "e-learning" sessions, with a 100% participation rate.

We also provide annual training for each job level, including risk and compliance seminars for top management led by guest specialists, training sessions for new managers, and new employee training, along with annual group training based on Takara Group Compliance Action Guidelines for risk compliance leaders who promote workplace compliance education. The group training promotes understanding of the role of risk and compliance leaders, respect for human rights, prevention of harassment, and the prevention of all forms of misconduct and corruption, such as bribery, kickbacks, and embezzlement, and other important compliance-related topics as appropriate to the time of the year. Furthermore, based on these subjects that the group training deals with, the compliance leaders provide on-the-job training at their offices as part of our companywide compliance education.

Themes for e-learning for compliance training for employees (April-December 2023)

|

Anti-fraud and anti-corruption |

SNS |

Appropriate expense processing |

Cyber Attack |

|

Pregnancy discrimination and Discrimination against fathers taking paternity leave |

LGBTQ |

Information Management |

Helplines |

|

Moderate Drinking |

Generative AI |

Human rights |

Insider Trading |

In the event of a suspected compliance violation, the relevant departments and sections will collaborate to promptly confirm the details of the case, conduct a detailed investigation of the facts, and based on the investigation results, consider and implement countermeasures and recurrence prevention measures.

For cases deemed to be serious compliance violations, the outline and recurrence prevention measures will be communicated internally, and focused risk and compliance education will be conducted based on the case. The status of these efforts will be reported to the "Risk and Compliance Committee."

In addition, necessary disciplinary measures will be taken for serious compliance violations in accordance with the employment regulations.

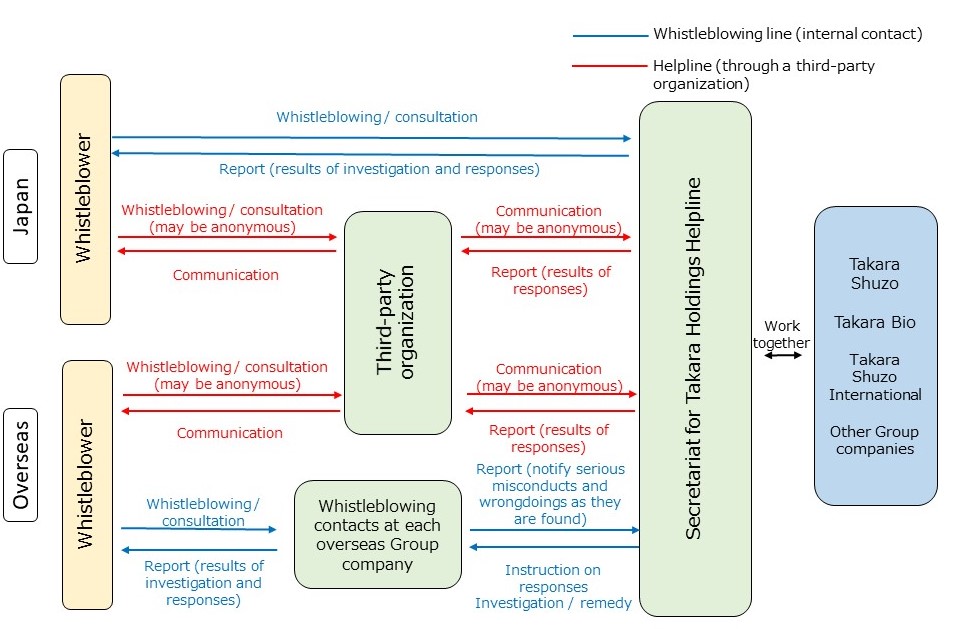

We have put in place helplines as contacts for whistleblowers in the event that they have noticed any legal infringements, unfair practices, corrupt practices, violation of human rights or behaviors in violation of social ethics such as bullying and harassment. In addition to a contact inside the Company, we also have an external (i.e., third-party organization) contact point to maintain the anonymity of whistleblowers. We operate these helplines in accordance with Japan’s Whistleblower Protection Act and the Helpline Rules in order to ensure that whistleblowers do not receive disadvantageous treatment due to the reports they have made. This includes promptly implementing corrective measures where the investigation reveals matters requiring rectification.

Our Group companies in overseas locations also have their local whistleblowing hotlines and have established and operate processes that allow their local employees to directly contact the helpline in Japan for reporting and consultation through a third-party organization.

To ensure the appropriate operation of the system, we conduct annual training sessions on helplines for risk and compliance leaders (selected from management at each company and workplace), who promote workplace compliance education. These sessions cover the entire process from receiving reports and consultations to final resolution, as well as the procedures for handling reports and consultations received directly without using helplines.

| Initiative themes | Specific measures |

Targets |

|

Reinforcement of the risk management structure |

Promote risk management (normal risk management) |

[ Entire Group ] Work to prevent the materialization of risks (including misconduct and corruption) and to mitigate risks surrounding companies inside and outside of Japan, and establish a system enabling quick and appropriate response in a disaster or other emergency. Monitor the state of risk management of each company and business site through measures such as workplace inspection reports, risk compliance checklists, and employee interviews to help reduces risks and prevent their materialization. (Once per year as a rule) Regularly hold various drills (e.g. confirming safety, fire-fighting, AED usage). (Once per year as a rule) |

|

Appropriately operate the whistleblowing system |

The Takara Group strives to prevent the materialization of risks (including misconduct and corruption) and to mitigate risks by thoroughly checking each workplace for any potential risks and taking preventive measures according to the findings. We also confirm the effectiveness of these measures against risks annually and review these measures if necessary. These activities are repeated every year, and the status of risk management activities throughout the year is reported to and monitored by the Risk Compliance Committee. Through these efforts, we aim to reinforce the risk management structure.

At the Takara Group, we have developed a Business Continuity Plan (BCP) to anticipate risks in emergencies. For example, in the event of natural disasters (such as earthquakes or typhoons), we have established measures to ensure the safety of employees, executives, their families, and external visitors as quickly as possible after the occurrence of damage. Additionally, we have outlined actions to restore and continue providing products and services to customers. We also ensure power supply at production sites by introducing self-generating equipment, deploy multiple communication methods, and prepare backup offices for disaster scenarios. The effectiveness of these plans is verified through regular drills.

Furthermore, we have developed response flows for situations that pose a threat to human life or health, such as infectious diseases or quality issues (e.g., product recalls), as well as for incidents that could significantly impact the company's reputation or assets, such as IT system failures or confidential information leaks. In emergencies, we promptly establish an emergency response headquarters and ensure that all departments collaborate to respond swiftly and accurately. We will continue to improve our Business Continuity Plan.

Initiatives to address risks anticipated in the Business Continuity Plan (BCP)

①Natural Disasters (Earthquakes, Typhoons, etc.):

Conducting safety confirmation drills during disasters such as earthquakes, fire drills at each workplace, and backup office* drills.

*An alternative office to be established at another business site in preparation for the temporary suspension of head office functions due to a disaster

②Infectious Diseases (Highly Pathogenic New Influenza, etc.):

Stockpiling of masks, disinfectant alcohol, etc., and establishing remote working environments to prepare for social infrastructure disruption and employees being unable to attend work.

③Quality Issues (Product Recalls, etc.):

Conducting emergency public relations response drills, including scenarios where a significant defect is discovered in a product.

④Suspension of critical operations and leakage of confidential information due to IT system failure:

Training in responding to suspicious emails, conducting incident response drills simulating cyber attacks and information security incidents, etc.