Based on the approval by shareholders at the 96th Annual General Shareholders’ Meeting, held on June 28, 2007, the Company introduced policies to be implemented in response to any large-scale purchase of the Company’s share certificates without prior approval from the Board of Directors, with the aim of maintaining or increasing corporate value of the Company and its Group and promoting the joint benefit of shareholders.

Subsequently, the partial amendment to and continuation of the takeover defense guidelines were approved at the 99th Annual General Shareholders’ Meeting, held on June 29, 2010 and at the 102nd Annual General Shareholders’ Meeting, held on June 27, 2013, respectively. As the takeover defense guidelines expire at the conclusion of the 105th Annual General Shareholders’ Meeting, held on June 29, 2016, the partial amendment to and continuation of the takeover defense guidelines have been resolved at the Board of Directors’ meeting, held on May 9, 2016. Following the approval of a provision entrusting the decision-making authority regarding the allocation of free stock acquisition rights to the Board of Directors at the 105th Annual General Shareholders’ Meeting, the amended takeover defense guidelines become effective.

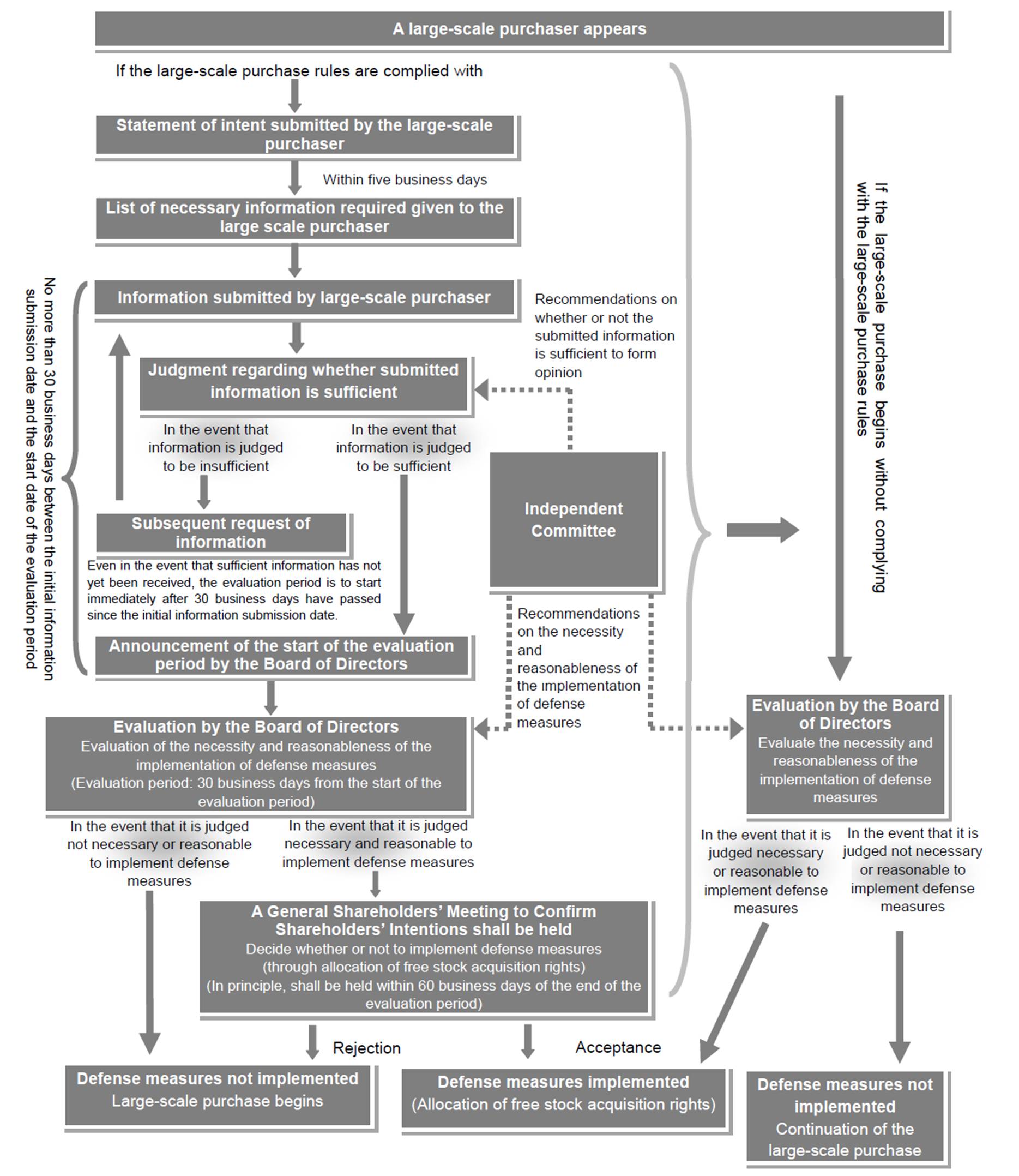

- The large-scale purchaser must provide the Board of Directors with sufficient information regarding the large-scale purchase in advance.

- (a) All large-scale purchasers shall wait until the end of the evaluation of the purchase proposal by a Board of Directors’ meeting, which shall be held no later than 30 business days from the start of the evaluation period, before starting their large-scale purchase.

(b) In the event that a General Shareholders’ Meeting to Confirm Shareholders’ Intentions is held, the large-scale purchaser shall not begin its large-scale purchase until the end of the General Shareholders’ Meeting to Confirm Shareholders’ Intentions.

Overview and Points of the Plan

|

Takeover Defense Guidelines of the Company |

|---|

|

Requirements for Application of the Plan |

A large-scale purchase is defined as a purchase offer of the Company’s share certificates where a specified shareholder group seeks to acquire a 20 percent-or-higher ratio of voting rights through a purchase of the Company’s share certificates, or where such a purchase will have the effect of giving the specified shareholder group a 20 percent-or-higher ratio of shareholder voting rights |

|---|

|

Establishment and Composition of the Independent Committee |

Establishment of the Independent Committee that consists of three or more members who satisfy Independence Standards for Outside Officers of the Company and who are any of external directors and external audit & supervisory board members independent from the management of the Company, and impartial external experts such as lawyers and certified public accountants *Initially, the Committee appoints three members and all of them are external directors or external audit & supervisory board members of the Company |

|---|

|

The Major Role of the Independent Committee |

1. Evaluation whether submitted necessary information is sufficient and recommendations to the Board of Directors necessary information and the new evaluation period is to be set in the event that the purchase proposal is changed, and recommendations to the Board of Directors reasonableness of the implementation of defense measures of defense measures in the event that the large-scale purchaser fails to comply with the large-scale purchase rules with the Independent Committee and recommendations to the Board of Directors thereof |

|---|

|

Requirements for Large-Scale Purchaser |

1. Provision, etc. of necessary information concerning the large-scale purchase statement of intent by the large-scale purchaser based on a necessary information list provided to the large-scale purchaser within five business days from the following day of the receipt date of the statement of intent objective of, and purchase conditions and methods for the purchase proposal, as well as the management policy and business plan of the Company after the purchase. the following period By the end of the evaluation period (within 30 business days from the start date of the evaluation period) Shareholders’ Intentions to be hold, by the conclusion thereof) |

|---|

|

Start Date of Evaluation Period |

Within 30 business days from the initial information submission date |

|---|

|

Evaluation Period |

Within 30 business days from the start date of the evaluation period |

|---|

|

Holding the General Shareholders’ Meeting to Confirm Shareholders’ Intentions |

To be held when the Board of Directors judges necessary or reasonable to implement defense measures(The Board of Directors judges the necessity and reasonableness of the implementation while respecting the recommendations of the Independent Committee to the maximum extent) |

|---|

|

Decision-making Institution on Implementation of Defense Measures |

[ Comply with the large-scale purchase rules ] General Shareholders’ Meeting to Confirm Shareholders’ Intentions [ Fail to comply with the large-scale purchase rules ] Board of Directors (the Board of Directors respects the recommendations of the Independent Committee to the maximum extent) |

|---|

|

Contents of Defense Measures |

Allocation of free stock acquisition rights (See (Reference 3) for details of the stock acquisition rights) |

|---|

|

Term of Directors |

One year |

|---|

|

Total Number and Composition of Directors |

Nine Directors (including two external directors) |

|---|

|

Total Number and Composition of Standing Audit & Supervisory Board Members |

Two Standing Audit & Supervisory Board Members and three Audit & Supervisory Board Members |

|---|

|

Effective Period of the Plan |

Three years |

|---|

PDF download

The following represents an English translation of the original Japanese version of the Policies on Response to Large-Scale Purchases of the Company’s Shares, and is provided for the convenience of readers.